Pekic

After going public in January 2021 through a SPAC merger with Gores Holdings IV, UWM Holdings Corp’s (NYSE: UWMC) share price return lost⁓ 51% (YYYY). This may seem like a possible downside given that the business combination has been hailed as the the biggest SPAC transaction at the time with a valuation of approximately $16 billion. However, the company’s second-quarter 2022 revenue of $564.23 million beat consensus estimates of $64.45 million and was up 16.4% (year-over-year).

Thesis

Despite the 31.35% drop in revenue (QoQ), UWMC expects its loan production forecast to be between $23 billion and $28 billion in the third quarter and a higher margin of $75 billion. to $90 billion for the year 2022. UWMC management is laser-focused on the growth of the broker channel as it appears to be the fastest way to provide loans to consumers as opposed to the retail channel. The company has also reduced manual operations through the use of affordable technology and reduced loan origination costs to maintain a competitive edge. Overall, the company is eager to recruit more retail loan origination systems and pay a regular dividend as it believes it will continue to balance cash and profitability.

UWMC revenue declined 31.35% (TQ) from a peak of $821.8 million in Q1 2022 to $564.22 million in Q2 2022. The decline was attributed to lower revenue loan origination which fell 38.13% (YoY) to $296.54 million in the three months ending June 30, 2022. Loan origination revenue peaked at $1.554 billion in the six months ending June 30, 2021, but were reduced by 56.21% (Y/Y) to $680.41 million. UWMC’s production revenue was reduced during the six-month period (December 2021 to June 2022), due to a lower outstanding principal balance on mortgages, premiums paid on mortgages and the fair value adjustment during this period. As a result, fair value mortgages in the six months fell 69.5% to $5.332 billion from a peak of $17.473 billion in the six months ending June 31. December 2021.

It should be remembered that UWMC generates its income from three main sources of income: loan origination, loan servicing and interest income. Rising interest rates led to lower loan origination revenues amid increased competition in the market. To reduce persistently high inflation, the US Fed announced a rate hike of 0.75 percentage points in the third quarter of 2022, which further increased debt for credit cards, vehicle financing and other loans.

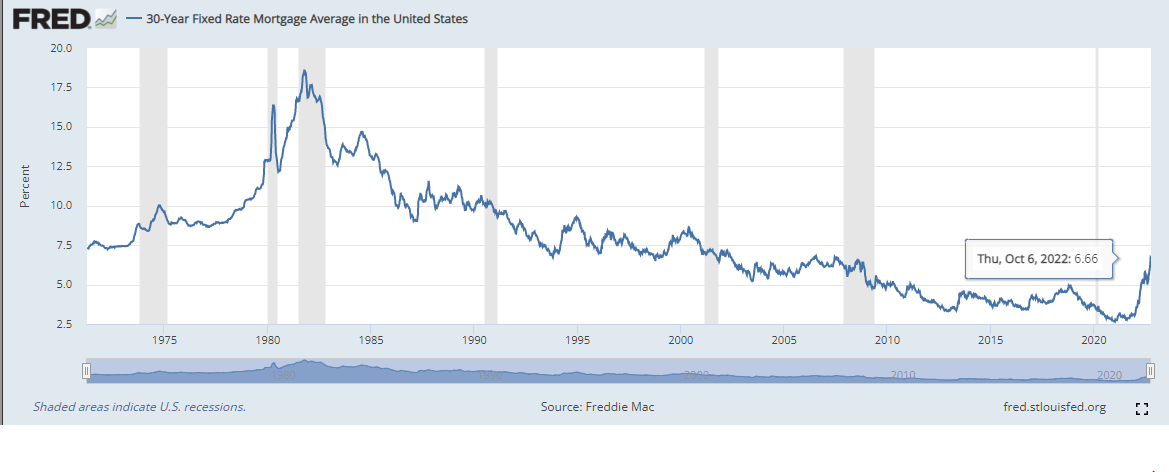

Over the years, rising interest rates have had minimal impact on fixed rate mortgages. However, customers getting a new mortgage or those with adjustable rate mortgages have seen their monthly payments change. Furthermore, there is also a direct relationship between mortgage rates and the bond market.

Fred

Since the start of 2022, mortgage rates have risen from 3% to 6.6%. Analysts have calculated that this increase means that the monthly premium cost of a 30-year fixed rate mortgage of $400,000 (with a down payment) of 20% increased to nearly $569.

Returning to the production guidance, UWMC explained in its second quarter 2022 earnings call that it expects production of $23 billion and $28 billion for the third quarter of 2022. However, these forecasts are lower than the mortgage production for the second quarter of 2022 which was $29.9 billion. CEO Mat Ishbia explained that $22.4 billion was bought in volume, indicating a 17% increase (QoQ) and a profit margin of between $30 and $60. In defence, the management has expressed its desire to work on the company’s long-term investment and more particularly the broker channel to build margins over time.

Brokerage channel and pricing strategy

CEO Mat Ishbia highlighted his support for the broker channel as opposed to the retail method with evidence that it helps customers save money. In his words, Mat remarked,

The average borrower will save $9,400 over the life of the loan by going through the broker channel versus the retail channel. It’s even better for minority borrowers who save around $10,400 by using a broker.”

It can be seen that wholesale lenders like UWMC work with brokers to have the benefit of having their profiles reviewed by a third party before processing loan applications. Retail lenders such as Rocket Companies, Inc (RKT) find customers and accept, lock, and process loan applications without the use of brokers. This explains why they have higher margins since they exclude additional brokerage fees from loan rates.

On the face of it, UWM is poised to raise mortgage rates to accommodate brokers in this new environment. However, it appears this wholesale lender intends to beat its rivals by still offering competitive pricing to brokers (squeezing its margins), a move that will help them navigate the mortgage market.

In the second quarter of 2022, UWM announced that it had lowered its marginal rates by 50 to 100 basis points on all types of mortgage loans. I believe the company is considering establishing a two-pronged strategic pricing platform. It will first show a broker where to place a loan i.e. give the characteristics of an ideal client – based on a pricing model and turn retail loan officers into wholesale brokers. UWM’s central goal is to match pricing with competitors’ loans and I think that’s what Game-on Pricing means.

Through his website, Game-on has set up a campaign to recruit independent mortgage brokers, a scenario aimed at reducing its administrative costs. During the three months ending June 30, 2022; UWM’s total expenses increased by 1.0% (TQ) and 7.7% in the six months from December 31, 2022. I expect the increase in the number of mortgage brokers independents leads to lower operating expenses in the coming quarters. The goal is to help the company generate more operating leverage through 2023. In addition, the adoption of this technology will increase the efficiency of mortgage brokers, increase production revenue levels and will provide quality loan offers to customers.

Dividend income

UWM announced in the second quarter of 2022 that it had made fully diluted earnings of $0.09 per share. The company has issued a regular dividend for the past 7 quarters, with the latest showing a yield of 12.42% (TTM). Despite lower loan production revenue, UWM’s cash position was just under $1 billion (at $958.66 million – an increase of 31.13% in the six months from 31 December 2021).

The company said there is sufficient cash not only to meet its cash needs through the end of the year, but also to support the payment of dividends in the third quarter of 2022.

Downside risks

While I don’t think there’s a real estate recession in the US, dividend income wouldn’t be the best thing to consider if there is. Analysts considered the increase in mortgage rate as an indication that a real estate recession is imminent. Demand for mortgages has also fallen by 30% (year-on-year) and sales transactions have also slowed. From an economic perspective, a drop in demand followed by an increase in supply will likely force prices down.

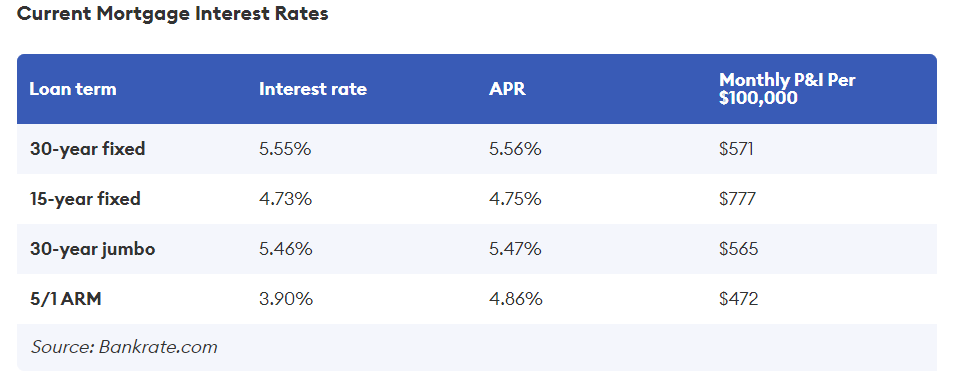

Forbes

There was a gradual increase mortgage rates, particularly in 2022, and as expected, any decline in rates will attract more mortgage applications. Right now, we can see that there have been lower levels of loan production as evidenced by UWM’s balance sheet. Nevertheless, we must bear in mind that the rate offered to clients depends on, among other things, the credit rating, the debt to income ratio, proof of constant income and the loan to value ratio.

Conclusion

UWMC is working to implement operational efficiencies across the mortgage business through its Game-on strategy. The company’s pricing initiatives have also been rolled out to attract not only brokers but potential customers as well. Investors have received regular dividends over the past 7 quarters, with the company pleased with its strong liquidity through 2023. The main challenge for the company is the slowdown in the real estate market which threatens to reduce demand. Nevertheless, the company is working to reduce its operating expenses in order to stabilize its cash flow for the year. For these reasons, we offer a holding rating for the title.