Our goal at Credible Operations, Inc., NMLS Number 1681276, hereafter referred to as “Credible”, is to give you the tools and confidence you need to improve your finances. Although we promote the products of our partner lenders who pay us for our services, all opinions are our own.

If you’re a veteran or active duty military and need student loans for college, here are 4 ways to pay for your college education. (Shutterstock)

If you’re a veteran trying to figure out how to pay for college, the military will cover a lot of your college fees in return for your service. The exact amount the government will pay depends on when and how long you serve.

If the military is not covering the full cost of your tuition, you have other options to fill the funding gaps. Here are four ways veterans and their dependents can pay for their education.

Private student loans are an option to help pay for college education. Credible allows you compare private student loan rates from multiple lenders, all in one place.

1. Apply for Post-9/11 GI Bill (Chapter 33) Education Benefits

The Post-9/11 GIs Bill (Chapter 33) provides educational resources and housing to people who served at least 90 days on or after September 11, 2001. You are also eligible for this benefit if you were discharged for a service-related disability after 30 days.

If you qualify for the maximum benefits, the government will cover all tuition and fees to attend a public university located in the state. If you attend school more than half the time, you will receive money for housing and up to $1,000 for books and supplies per school year.

Also, you may be able to receive money to help you leave a rural area to go to school. If you live in a county with six or fewer people per square mile and you travel at least 500 miles to attend school, you may qualify for a one-time payment of $500 to cover your moving expenses.

You will need the following documents to apply:

- Social Security number

- Bank account information for direct deposit

- Your education and background with the military

- Information about the school you plan to attend

You can apply by mail or in person at a VA Regional Office near you.

GI invoice for dependents

Some veterans may be eligible to transfer their unused benefits to a spouse or dependent children. To qualify, all of the following statements must be true:

- You have completed at least six years of service.

- You accept four additional years of service.

- The person receiving the benefits is enrolled in the Defense Enrollment Eligibility Reporting System.

If the Department of Defense approves the transfer of rights, your spouse or dependent child may receive money to cover tuition, housing, and supplies.

If you need private student loans, visit Credible for compare private student loan rates from various lenders in minutes.

2. Complete the FAFSA and Apply for Scholarships

If the Post-9/11 GI Bill does not fully cover your tuition, the next step is to complete the Free Application for Federal Student Aid (FAFSA) to see if you qualify for federal grants. These are usually awarded to undergraduate students, and this money does not need to be refunded.

Schools use the information on your FAFSA to determine if you are eligible to receive federal grants. And a number of grants are available that are specifically geared toward service members and their dependents.

For example, children of veterans who died serving in Iraq or Afghanistan after 9/11 may be eligible for Iraq and Afghanistan Service Grant. This grant is equal to the amount of a maximum Pell grant, but it cannot exceed your total cost of attendance for the school year.

3. Take out federal loans

Once you have submitted the FAFSA, you will know if you qualify for federal student loans. Federal loans come from the US Department of Education and have lower rates and more protections for borrowers than private loans. student loans.

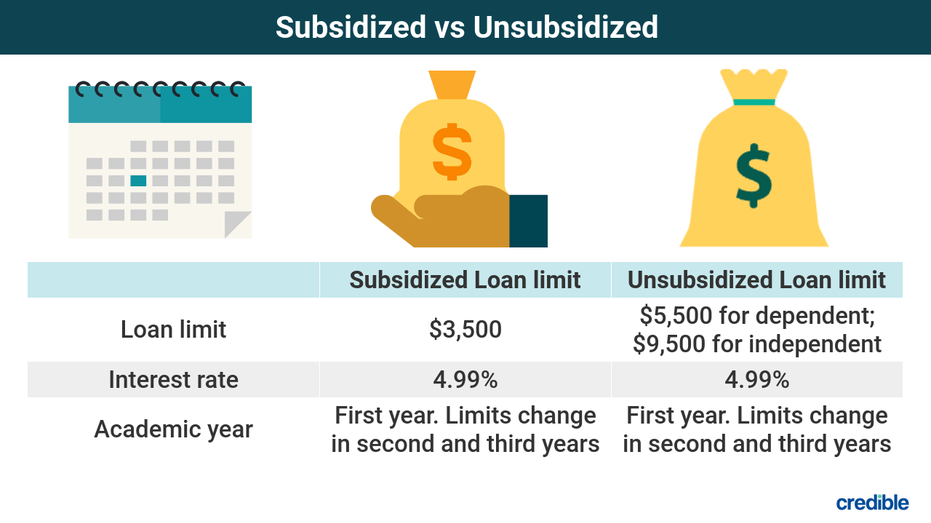

You should know two main types of Federal Direct Student loans — subsidized and unsubsidized. Subsidized student loans are available to undergraduate students who can demonstrate financial need. The government pays interest on these loans as long as you are enrolled in school at least part-time, for the first six months after leaving school, and while your loan is on suspension.

In comparison, unsubsidized student loans are available to all undergraduate students, whether or not they can demonstrate financial need. But you are responsible for paying the interest while you are still in school.

Here’s a closer look at the difference between each type of federal student loan:

4. Consider private student loans to fill the gap

If you still have gaps in your education funding, you can apply for a private scholarship student loans. Private loans are available from banks, credit unions and online lenders. They are a good option for borrowers who need financing beyond what federal loan limits allow.

If you are applying for private student loans, it is important to compare your options among several different lenders. This will allow you to benefit from the most favorable rates and conditions for your loan.

When comparing lenders, you need to consider the interest rates offered to you. But you should also consider your repayment plan, if there is a release of the co-signer option, the amount of fees charged by your lender, and any student loan deferral or cancellation options.

With Credible, you can compare private student loan rates without affecting your credit.