Anil Kashyap explains the research of Douglas Diamond, who won the 2022 Nobel Prize in Economics. This post originally appeared on Chicago Booth Global Markets Initiative.

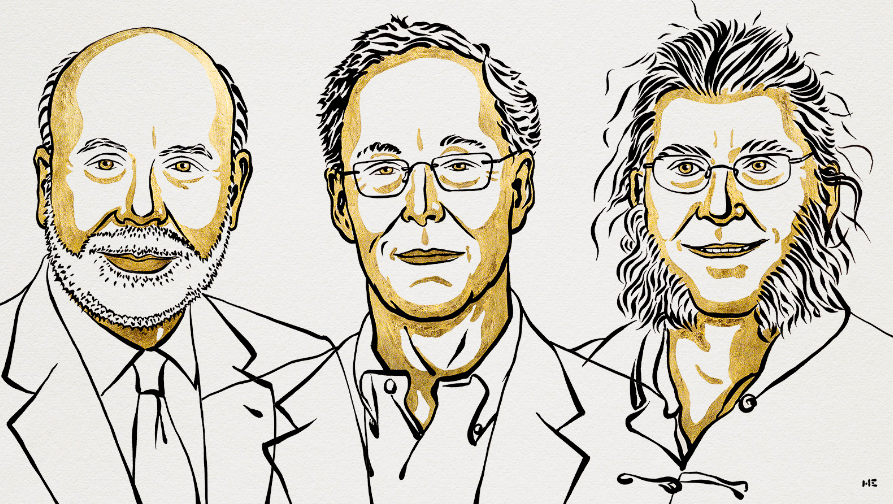

The 2022 Nobel Prize in Economics was awarded to former Fed Chairman Ben Bernanke of the Brookings Institution, Douglas Diamond of Chicago, and Philip Dybvig of Washington University in St. Louis “for their research on banking and financial crises. Anil Kashyap explains the reasons for this recognition.

This year’s Nobel Prize in Economics should be seen as recognition of research that informs our thinking about three questions about banks: i) Among the many activities of banks, what are the essential characteristics? ii) Why are banks the institutions that fulfill these functions? iii) What happens when things go wrong in banking?

The answers can be found in three articles cited by the Nobel committee which were all published in the early 1980s: two theoretical contributions by Diamond and Dybvig (1983) and Diamond (1984); and an empirical contribution by Bernanke (1983).

This research shows that the essence of banks is to take deposits that transmit services (eg, checking accounts) from savers and use the funds to make loans to households and businesses. In other words, banking assets (loans) and liabilities (deposits) have value and you cannot understand banking without recognizing both functions.

This may seem trivial, as deep ideas often do, but it is hardly obvious. For example, after periods of financial instability, one often hears commentators ask why are banks allowed to gamble with savers’ money? If we just forced them to be much, much safer (say, only investing in government securities), they wouldn’t cause so much trouble. The work of the laureates explains why lending and deposit naturally coexist.

The theory starts from the research of Diamond and Dybvig. They ask why would a company usefully offer demandable deposits? The alternative is that individuals could simply buy short-term safe securities themselves, which could be bought and sold as needed. They point out that in most cases people will not have an immediate need to make payments, so it is expensive (in an opportunity cost sense) for everyone to self-insure and save using only the most liquid savings vehicle.

While we recognize that most savers will not need their savings at some point, they could invest their savings in higher yielding assets. Of course, if they need to sell these assets, it will cost them dearly because they get higher returns because they are illiquid.

The solution to this tension is to create an organization (a bank) that pools the needs of several people and assumes that not everyone will need their savings at the same time. The bank essentially becomes an insurance vehicle, where it mainly invests in the illiquid assets and sells some of those assets as needed to meet the withdrawal needs of people who really need funds urgently. This allows the bank to pay a higher return on checking accounts in exchange for paying slightly less on longer-term savings accounts. Because none of us know exactly when we might need to make a payment, it’s an attractive service.

Unfortunately, the arrangement comes with an obvious flaw. Insurance breaks down if everyone decides they want their money back. The bank has no way of separating who really needs to withdraw from who might do so because of panic. I can go to the bank because I see a line there, not because I need my money. As Diamond often says, the fear of fear itself is a problem. There are different ways to solve this problem, with deposit insurance and liquidity regulation being obvious candidates.

This begs the question: why invest in loans then? This is the question that Diamond (1984) answers. He points out an issue that anyone who makes a loan has to deal with is what to deal with the risk that a borrower may not be able to repay the loan in full. The sensible thing to do in this case is to renegotiate and get whatever is available.

Unfortunately, if the borrower knows this is an option, they will always claim they cannot repay and seek a reduced amount. The best way to handle this is for the lender to monitor (check) the borrower for repayment prospects. For any individual saver, this follow-up would be very costly: most will not have the expertise to do so. Moreover, the interest that each saver would have to charge to cover this cost would be very high.

This suggests that pooling funds may once again be attractive. Suppose that many savers hand over their money to a specialist, the bank, and that specialist makes many loans and monitors the borrowers. Sounds appealing, but runs into the “who’s watching the monitor” problem?

Savers who have given their money to the financial institution to invest now face the same problem as if they each wanted to lend individually to an end borrower. The bank may say that it cannot repay the deposits because the borrower has defaulted. How do you know if the financial institution is telling the truth about what it has learned by monitoring the borrower?

Thus, it may appear that the agents will each have to monitor the financial institution, which means that they need the bank to pay them enough interest to cover this cost. It seems that pooling and delegating are not helpful.

Diamond’s (1984) central idea is that the “who controls the controller” problem can be overcome by requiring the financial institution to make many loans. If the financial institution has a well-diversified set of loans to many different borrowers, it is unlikely that all of the loans will fail at the same time. It will not be credible for the financial institution to lie and claim that its borrowers have not paid, and it will not have to monitor to find out.

In this case, the financial institution will reimburse its borrowers using the proceeds of successful investments. By spreading the risk over many loans, the cost of borrowing in the economy decreases (compared to the case of direct lending) and duplication of control by depositors is avoided.

Thus, between these two papers, we see that it makes sense for banks to both make deposits and make loans. This raises the final question of whether this arrangement creates problems for the economy. Bernanke (1983) is one of many articles showing that when banks fail, the global economy suffers. What is the source of the overflows?

The seminal work of Friedman and Schwartz (1963) suggested that the problems stemmed from losses for savers. Studying the Great Depression, they argued that when banks collapsed, savers lost access to their deposits. Without these deposits, individuals and businesses could not make payments, and without payments, the economy could not function.

Of course, this is not the only explanation. When bank deposits fall, so do loans. Therefore, we cannot say whether it is the implosion on the lending side or on the deposit side that is critical. (In reality, it’s probably a bit of both).

Bernanke (1983) argues that there was a clear role in worrying about the credit crunch per se. He noted that theoretical and empirical work suggested that it was not just the collapse of liabilities that mattered, but also the loss of loans that had an independent effect.

For example, during the Great Depression, large businesses that had nonbank sources of credit fared better than small businesses and farmers, who were particularly reliant on banks. He also pointed to contemporary survey evidence showing that companies reported the pressure to repay loans and the unavailability of new bank credit as a source of stress in the economy.

Bernanke’s work sparked a wave of subsequent work, much of it by him, aimed at establishing the importance of shocks to bank lending (and credit supply more generally) as a major source of instability for macroeconomics. As the award citation noted, this attention to preserving lending capacity and credit availability was a central consideration driving economic policy during the 2008 global financial crisis.

Similarly, much of the regulatory response to the global financial crisis has been informed by research from Diamond and Diamond and Dybvig. For example, the idea that demand claims offered by money market funds (and other non-banks) are subject to runs has been widely accepted as a risk that needs to be addressed.

I hope this brief visit gives some idea of the importance of this work. This has had a profound effect on the direction of research and on our understanding of the role of banks in the economy. Perhaps just as important, it dramatically altered economic policy and the practical way the financial system is regulated. For these two reasons, this research deserves the Nobel Prize.