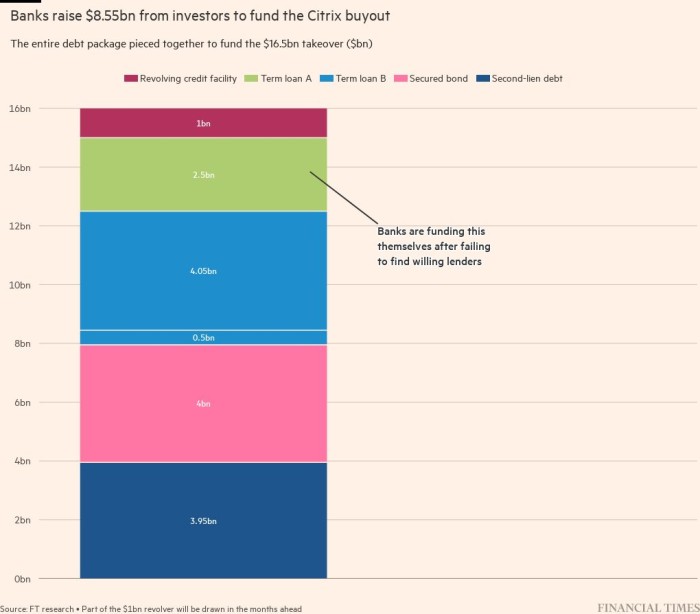

Banks lost $600 million this week when they completed the biggest junk bond sale of 2022. Yet the financial damage inflicted by underwriting the $16.5 billion leveraged buyout of Citrix may be just getting started.

After offloading $8.55 billion in bonds and loans at rock-bottom prices, lenders including Bank of America, Goldman Sachs and Credit Suisse still have billions of additional Citrix debt on their books, worth much lower than what they agreed to subscribe to in January. And banks are still holding far more debt from financial packages supporting takeovers of TV valuation group Nielsen, TV broadcaster Tegna, auto parts maker Tenneco and, if completed, the Twitter takeover. by Elon Musk for $44 billion.

The sale of Citrix debt was seen as a test of capital markets which have been reeling since Russia invaded Ukraine, global growth has cooled sharply and central banks from Frankfurt to Washington have began to aggressively raise interest rates. Demand was weak, with fund managers preferring to hold cash or higher quality investments rather than lending to risky businesses and private equity firms. A banker involved in the case said it was a “bloodbath”.

Interest was so low that one of the investors to buy $1 billion worth of bonds was Elliott Management – which, along with Vista Equity Partners, is also one of two private investment groups buying Citrix, according to people informed about it and documents consulted. by the Financial Times.

“We had to put the pig through the python,” said a second banker involved in financing the takeover. “Everyone was getting comfortable in August, but unfortunately Jackson Hole happened and then everything went haywire,” the banker added, alluding to remarks by Federal Reserve Chairman Jay Powell. in Jackson Hole, Wyoming, last month, where he made clear his desire to control inflation with higher interest rates.

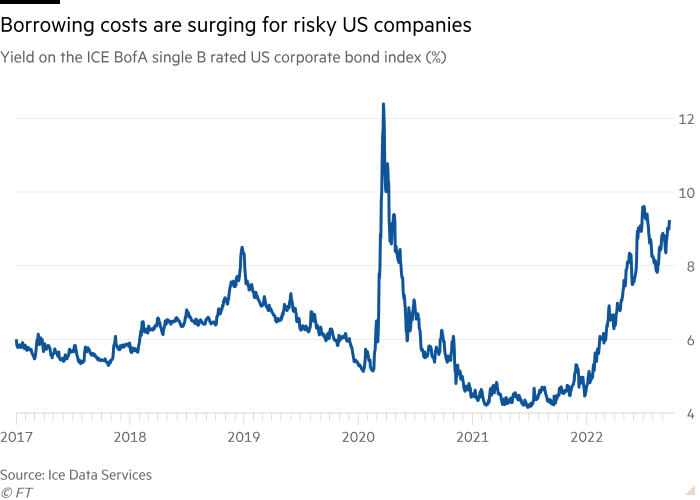

Borrowing costs have jumped. When banks were rushing to lend to businesses and private equity firms earlier this year, a US company with a low B debt rating could expect an interest rate of around 4.74% . The rate is 9.2% today. As Citrix has demonstrated, even this level may not be sufficient to attract potential creditors.

The bankers ended up selling $4 billion worth of Citrix covered bonds at a discount price of about 83.6 cents on the dollar for a 10% yield. Another $4.55 billion in loans were sold at 91 cents on the dollar, also to yield 10%. For banks that agreed to lend to Citrix buyers before the Fed began to tighten, the resulting losses have been painful.

“After a period of gluts of liquidity, when rates rise that much, a bubble that has formed somewhere bursts,” said Bob Michele, head of the global fixed income, currencies and commodities unit at JPMorgan Asset Management. “It’s happened every time, and it shows you the Fed has done its job.”

The Citrix deal captivated the market in part because of its size, but also because of the relatively small equity investments Elliott and Vista made to buy the enterprise software company. To support the sale of the gargantuan debt, Elliott contributed more than $2 billion in cash while Vista merged its already leveraged Tibco software business at a valuation of more than $4 billion.

Banks were so greedy in January that they had no trouble convincing risk managers to sign the giant deal they agreed to sign. Citrix’s high level of debt has become increasingly costly, with some dealmakers privately concerned that rising interest costs could eat up most of its cash flow.

Citrix is not alone. Among the deals causing heartburn on Wall Street is Musk’s takeover of Twitter, a deal he is trying to back out of. But unless a judge sides with the billionaire – or the social media group’s board agrees to end the deal – a group of seven banks that have agreed to lend $13 billion dollars in April for the buyout are still hanging in the balance despite the company’s recent troubles and market downturn. It’s a deal that investors say would result in huge losses for underwriters.

Bankers involved in the Citrix financing told the FT they were relieved they were able to finalize the $8.55 billion debt deal and it did not collapse. While they still hold about $6.45 billion worth of Citrix debt on their balance sheets — including some of the riskiest bonds they couldn’t sell — the fact that the markets weren’t completely closed gave them the hope that they will be able to sell more seated debt. on their books.

But lackluster demand, including banks’ failed attempt to offload junior debt from Citrix over the summer, will nonetheless hamper Wall Street’s ability to underwrite new low-rated loans. The fact that some of the largest lenders in the United States hold some of the riskiest debt may also worry regulators.

“It feels like even when the banks have the deal, there’s still a surplus,” said a senior executive at a major lender.

Bank of America, Credit Suisse and Goldman Sachs declined to comment.

As banks closed their doors to new business to iron out problematic financings, frustrated private equity buyers turned to direct lenders such as Blackstone, Apollo and Ares, which financed ambitious privatizations like with Zendesk and Avalara this summer.

“Banks have been pretty much on hold,” said the head of a large firm that buys syndicated bank debt. “Direct lenders are upselling into larger deals and taking business away.”