Inna Dodor/iStock via Getty Images

Ares Capital (NASDAQ: ARCC) has been on the rise lately. At its recent Investor Day, management vaunted the following achievements over the past three years:

- reduce miss counts from 50% to a miniscule 1.2%;

- growing income per share of 13%;

- increase the dividend twice in addition to the special dividends;

- Net asset value per share growth of 10.6% (~3x BDC industry average);

- generated an annualized total return of 10.9% (260 basis points above the BDC (BIZD) sector average).

In the future, the ARCC also has a lot to do. Thanks to its scale, the backing of its large global alternative asset management parent company Ares Management (ARES) and its track record, ARCC enjoys access to superior deal flow and greater diversification than good. many of his BDC colleagues. In fact, ARES is the world’s largest direct loan manager, with $147 billion in direct loan assets under management. ARCC is also the largest publicly traded BDC, with a $19.5 billion investment portfolio spread across 395 companies, most of which are in defensive industries.

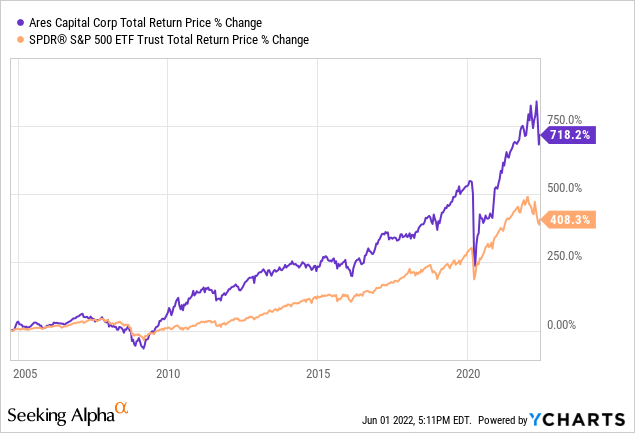

On top of that, it has a proven business model that has weathered a wide variety of economic cycles admirably. In fact, despite going public before the Great Financial Crisis of 2008, the ARCC has crushed the S&P 500 (SPY) since its inception with an annualized total return of around 13.5% compared to a total return 10.4% annualized for the SPY over this period.

This is largely a tribute to ARCC’s excellent underwriting approach and portfolio management skills, in addition to its strong, investment-grade balance sheet. The company has also positioned itself to perform well in a rising interest rate environment, and investors have reason to believe it can maintain strong profitability going forward. This is in line with its 10.4% annualized core return on equity achieved over the past 5 years, 80 basis points above its peer group average.

Last, but not least, ARCC’s recent performance reflects strong performance momentum. For example, net asset value per share increased 0.4% sequentially and 9% year-on-year in the first quarter, the balance sheet deleveraged from 1.26x in the fourth quarter to 1.13x in the first quarter, and Management emphasized on the earnings call that ARCC is well positioned for a rising interest rate environment (emphasis added):

we do not believe that a cycle of monetary tightening will have negative effects on us. Our large floating rate loan portfolio is funded primarily by fixed rate unsecured funding sources and our assets are largely floating rate investments. We believe this puts us in a good position for our net interest income to benefit from rising rates. At the end of the quarter, all things being equal and after taking into account the impact of revenue-based expenses, we calculated that a 100 basis point increase in short-term rates could increase our annual earnings by approximately $0.23 per share, an increase of 14% over this quarter’s base EPS run rate.

A 200 basis point increase in short-term rates could increase our total annual earnings by approximately $0.44 per share, a 26% increase over this quarter’s EPS base rate.

We also don’t expect a projected rate hike to cause credit performance to deteriorate, especially given our strong starting point with a portfolio weighted average interest coverage of nearly 3x. This means that, all other things being equal, including borrower-level leverage, short-term base rates would need to rise above 3% before aggregate interest coverage falls below 2x, which is similar to the 5-year pre-borrower period. pandemic weighted average of 2.3 times.

It is important to note that this analysis does not take into account the EBITDA growth or deleveraging that often occurs in our portfolio. We are pleased with the ability of our portfolio companies to navigate a higher rate environment and believe this dynamic will further differentiate Ares Capital from most other income-focused alternatives in the market today.

Worrying clouds on the horizon for the dividend?

That said, we believe investors should remain cautious about their investments – especially high-yield ones that are typically relied on to generate income – instead of blindly jumping on the management propaganda bandwagon.

While the CEO asserted on the earnings call that the dividend was safe:

I mean our undistributed taxable income and our dividends. We currently estimate that our overhead revenue from 2021 to 2022 will be approximately $651 million or $1.32 per share. We believe that having strong and meaningful retained earnings supports our goal of maintaining a stable dividend through market cycles and sets us apart from many other BDCs that do not have this level of earnings.

there are a few reasons to be a bit concerned:

#1. Ultra-thin dividend cover

First and foremost, basic earnings per share were down 2.3% year over year and barely covered the dividend with a 100% payout ratio. This leaves the company very little room for error if it wants to fully cover its current dividend.

It is also important to note that this extremely thin dividend coverage is despite the fact that ARCC’s non-recognitions are at very low levels compared to its own history. If ARCC’s non-booking rate were to jump, ARCC’s dividend payout ratio would likely exceed 100%.

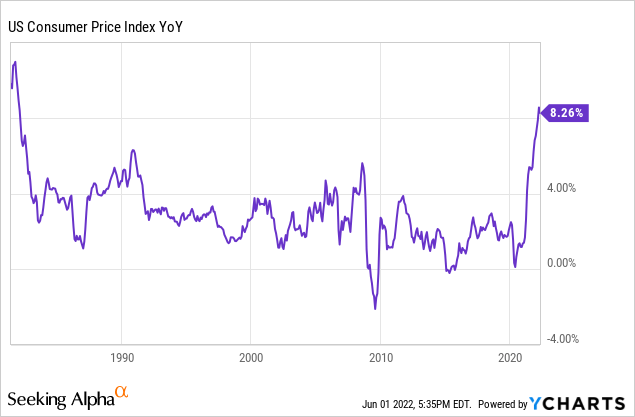

#2. An economic hurricane is brewing

Second, the macroeconomic environment is at best uncertain and at worst very poor. With inflation at its highest level in nearly four decades, supply chain headaches continuing unabated, and geopolitical tensions soaring in Eastern Europe and East Asia , the economy is currently under severe pressure.

Now there is a growing economic consensus that a recession is imminent. Even the CEO of JPMorgan (JPM) made an ominous statement:

We’re getting ready… It’s a hurricane. This hurricane is right there, on the road, and coming towards us… I watch the train go down the rails and I am very sad.

If the CEO of one of the world’s major banks (i.e. a lender that has a much more conservative lending profile than ARCC) is so concerned about the macroeconomic environment that he is preparing to the impending economic hurricane, this does not bode well for the ARCC.

Such a scenario would almost certainly lead to a dramatic increase in non-accumulations and even defaults on ARCC’s loan book which is filled with lower quality counterparties (hence why it is able to charge such high interest rates on its loans). In addition, its equity portfolio – although relatively small compared to its loan portfolio – would also suffer heavy losses.

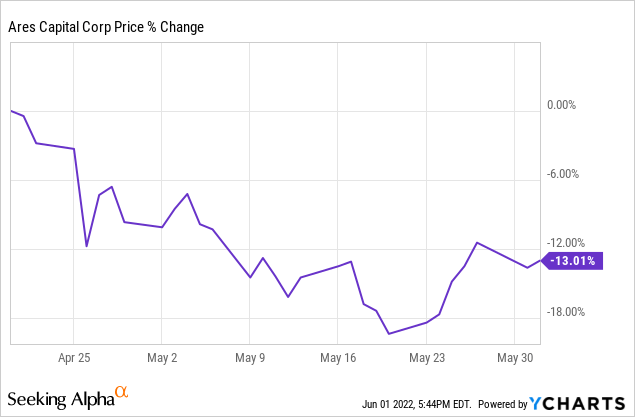

This concern helps explain why the stock has had a tough time lately, despite recent strong results:

Key takeaway for investors

Although the ARCC has a great balance sheet, its dividend coverage ratio has suddenly become quite tight, and with economic storm clouds on the horizon, the dividend isn’t exactly extremely safe.

In particular, retirees who rely on the ARCC to provide sufficient income to meet their day-to-day needs should be careful not to trust it too much as a dividend machine for sleeping well at night. If we see a severe recession, there is a very real possibility that the ARCC will have to cut its dividend.

That said, we also want to be clear that we remain bullish on the ARCC overall here. ARCC has more than $5 billion in cash from which to sustain its dividend even if earnings plummet in the short term, and admittedly the management has a proven track record.

In summary, ARCC is not an overnight income investment and investors should not blindly trust management, but rather carefully monitor the level of dividend coverage, level of non-accumulation and the state of the economy at large. However, we continue to believe that – barring a severe and prolonged recession – the dividend should be fairly safe and the risk/reward ratio remains attractive.